‘A sleeping talent is a gift one has, but they are not fully aware of its existence.’

Most of the time it takes doing something that requires using such talent in order to wake it up. It doesn’t have to be artistic though. Being good with numbers, for example, is a gift, which could come in handy one way or another, and be awaken by a genuine need (trying to figure out where all the money is going to 🙂

Recently, I’ve noticed an increasing interest in anything wood. Also noticed liking to go to hardware stores, enjoying the smell of wood, and exploring woodworking tools, raw wood boards and blocks.

It turned out that that was an actual sleeping talent (which might have its roots back in the childhood days), and when put to the test produced two handmade products, now posted on an aspiring new Etsy store, CanFour.

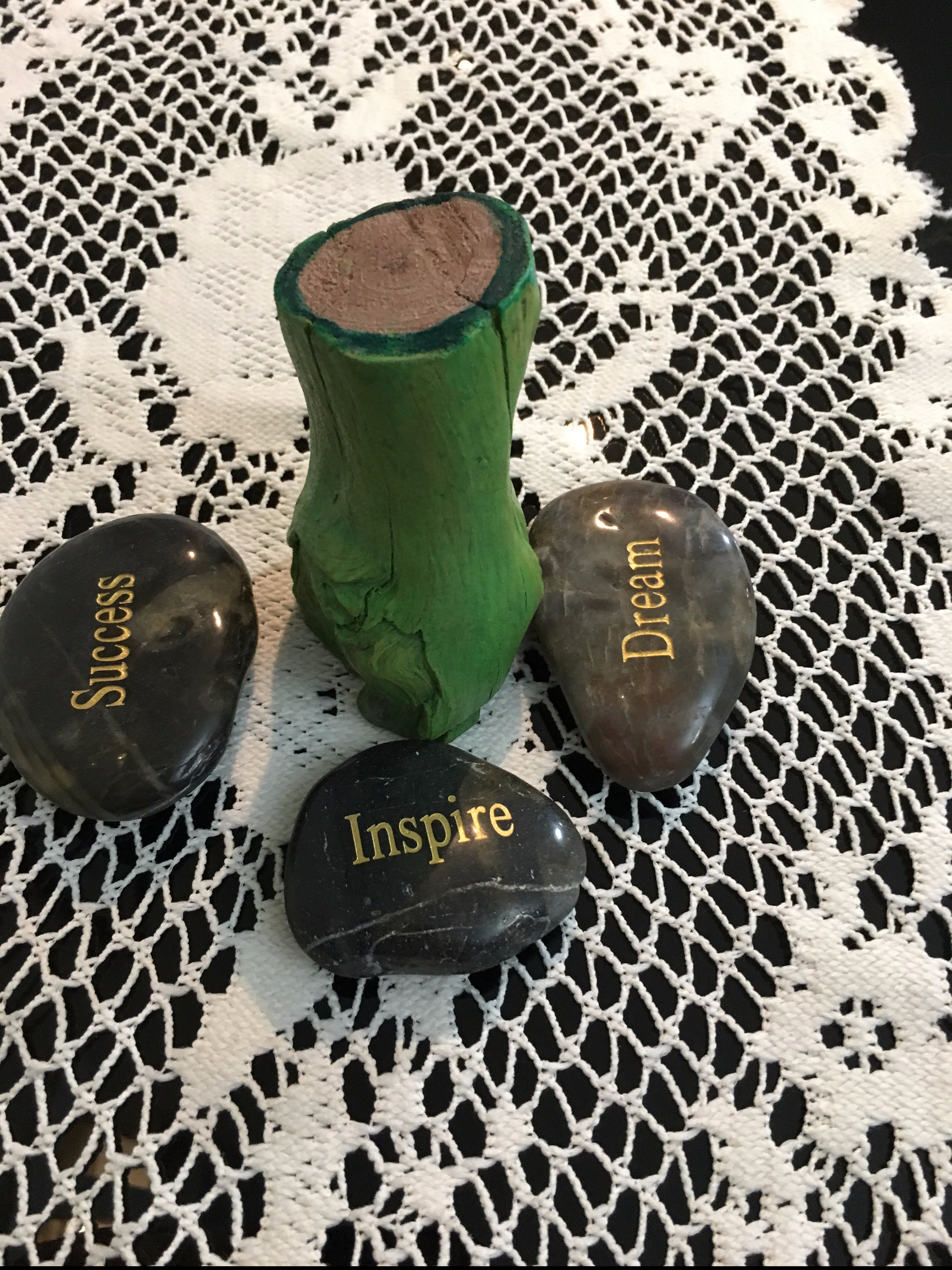

Handmade Craft Product

This is a handmade craft, made in Canada from 100% natural Interior BC wood. Inspired by the surrounding nature, and the gradual change of colors as we move from summer to fall. No machine was used, only simple, basic woodworking and painting tools and material. Listed on my Etsy store: https://www.etsy.com/ca/listing/565798587/natural-wood-miniature-tree-stool

C$45.00

Of course, monetizing a genuine/original talent comes with few considerations:

- Is it going to stay fresh and vibrant as product and financial concerns come into play?

- While producing one item is exciting and engaging, creating a product line is a different story

- Is there a market and what would drive sales?

- Is an online store the right business model?

Some might argue that business, namely marketing and sales, carries an artistic spirit. I’d agree, but this is a different flavor of art.

In this case, the business vision drove creativity! The decision to start an Etsy store as an element of a Multiple Streams of Income (MSOI) strategy preceded finding product ideas, let alone alone production. I’ve found that quite interesting. I guess the lesson here is the following:

‘It doesn’t really matter where and how innovation kicks in; whether it’s a hunch while taking a walk in the mountains, or an insight popping up during a deliberate planning session. What matters is how you capitalize on that and bring it to light.’

Going forward, you will notice that The Wealth Maker blog is becoming a proactive ‘voice’ of the emerging ventures. Furthermore, it will continue its mission to deliver quality knowledge and practical tips to wealth aspirants from all walks of life…

Till our next post, stay tuned and enlightened!

The Wealth Maker